Have you ever felt excited reading your job offer, only to feel confused a few months later when your bank balance didn’t match that excitement?

You’re not imagining things. Many companies design salaries in a way that *looks* impressive on paper but feels smaller in real life.

This isn’t illegal. It’s psychological. And once you understand it, you’ll never look at a salary slip the same way again.

When companies hire, they are not just offering money.

They are selling a feeling.

Big numbers feel good.

They signal success, growth, and validation.

That’s why most salary offers are framed around total compensation, not what you actually take home every month.

In simple terms, companies know one thing very well:

Your brain reacts faster to large numbers than detailed breakdowns.

Most offer letters highlight:

These numbers look impressive.

But they are not what lands in your bank account.

Your real salary is your **take-home pay** — the amount left after:

That gap between gross and net is where the illusion happens.

Many people don’t notice this gap until months later.

Let’s take an easy example.

Two people are offered the same salary: $60,000 per year.

Person A

Person B

On paper, both earn the same.

But monthly take-home pay tells a different story.

Person B often ends up with more money in hand, even though Person A’s offer looked more impressive.

This is why understanding salary structure matters more than the headline number.

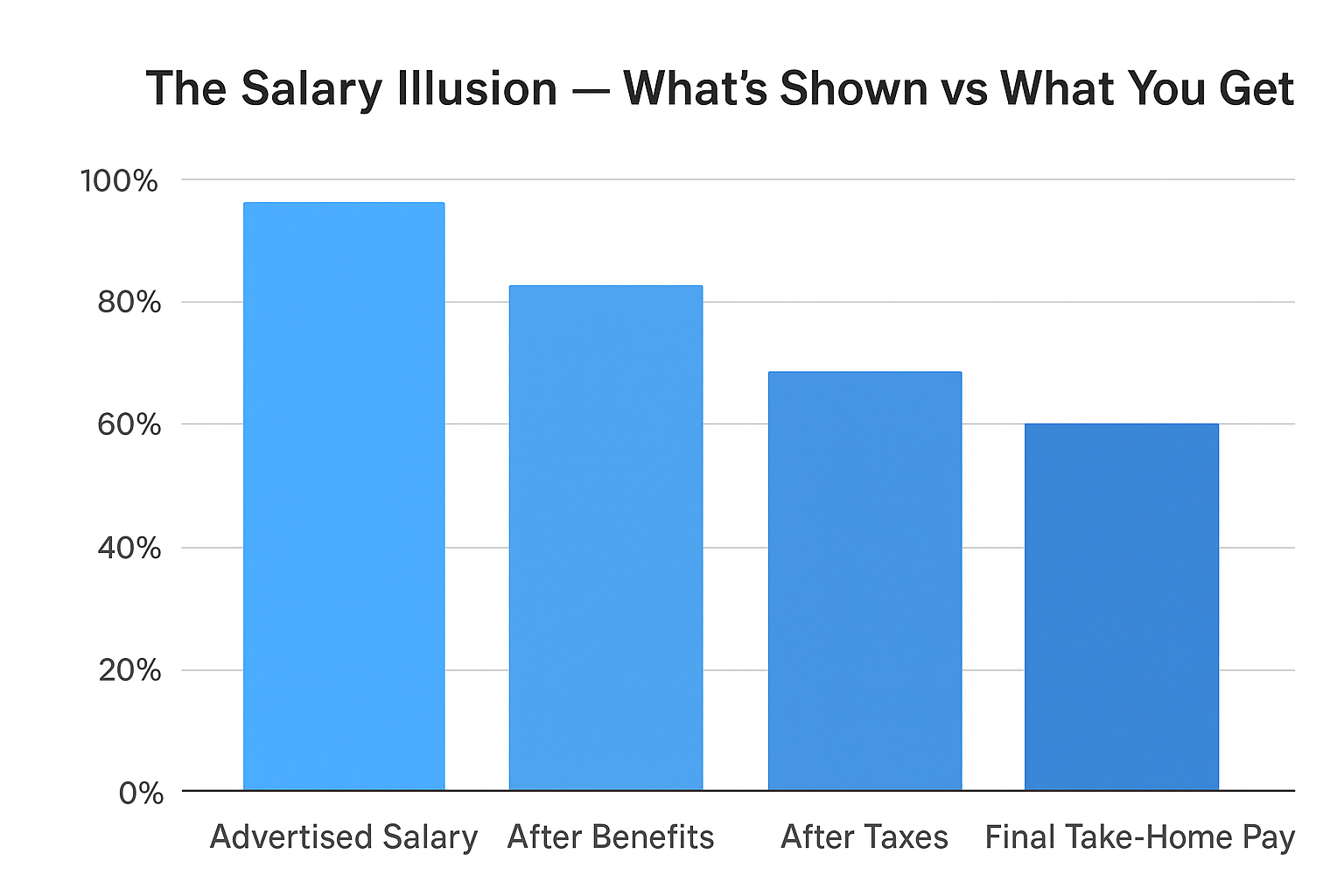

The above chart can help you understand the pattern easily.

Companies prefer annual figures because:

Your brain processes “$60,000 a year” as success.

You react emotionally.

But your expenses are monthly.

is monthly.

Groceries are monthly.

Savings are monthly.

That mismatch is intentional.

Allowances are one of the most powerful tools companies use to shape perception.

Common allowances include:

Some allowances are taxed differently.

Some aren’t paid every month.

Some disappear if conditions change.

But when added together, they inflate the salary figure in the offer letter.

On paper, it looks generous.

In practice, it’s conditional.

Bonuses are another psychological lever.

They sound like extra money.

But many bonuses are:

Companies often include *maximum possible bonus* in salary discussions.

Your brain hears: “I can earn this much.”

Your bank account hears: “Let’s see.”

This gap between promise and reality is subtle but powerful.

Have you noticed how salary slips are often complex?

That’s not accidental.

Multiple line items, technical terms, and deductions create distance between you and the real number that matters.

When things feel complicated, people stop questioning them.

This is why many professionals only look at:

But those ignored lines explain exactly where your money goes.

Using a simple salary-to-tax calculator to test different salary structures often reveals surprises people never expected — especially when bonuses or allowances change.

Even when take-home pay increases slightly, companies frame it as a major upgrade.

And technically, they’re not lying.

But psychologically:

So even a “higher salary” can feel tighter.

This creates confusion and self-doubt instead of clarity.

Experienced professionals don’t ask, “How much is the salary?”

They ask, “How much will I receive every month after everything?”

This single question cuts through all the tricks.

It turns negotiation into logic, not emotion.

When people quietly run their numbers through a calculator before accepting an offer, they gain leverage not just clarity.

Here’s the trick companies hope you don’t use.

Before accepting or negotiating any offer:

When you do this, salaries stop being confusing.

They become comparable.

That’s when you realize some “lower” offers actually give you more freedom.

To be fair, this isn’t manipulation in a dark sense.

It’s marketing.

Companies market salaries the same way brands market products.

Big numbers sell.

Details come later.

Once you understand this, you stop feeling fooled — and start feeling informed.

Many people chase higher salaries.

Fewer people understand how salaries actually work.

But the second group usually ends up better off.

They:

All from understanding one simple idea:

What looks big isn’t always big.

Because deductions, taxes, and conditional pay reduce what you actually receive. The headline number isn’t designed to reflect monthly reality.

Not always. But salary structures are designed to appeal emotionally first, not financially.

Focus on take-home pay. Breaking down your salary with a calculator gives instant clarity without assumptions.