Have you ever checked your bank balance and thought, *“Where did my salary go?”

You’re not bad at math. Your brain is simply playing tricks on you. Every month, small mental shortcuts make your salary feel larger than it really is. Once you understand these patterns, your money suddenly starts making a lot more sense.

Our brain loves simple numbers.

It hates details. That’s the core reason salary confusion exists.

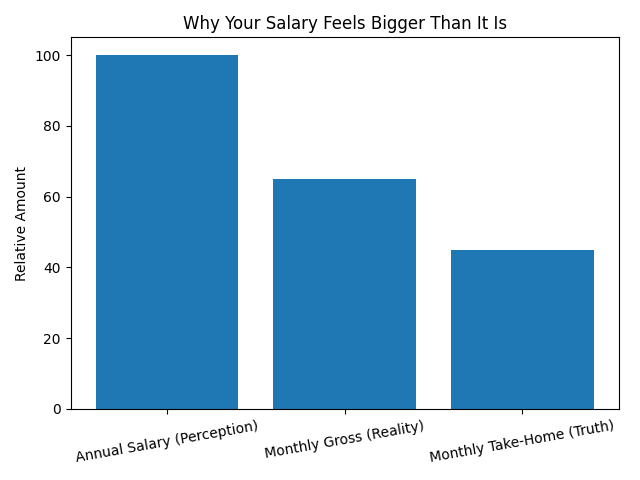

When we hear our salary, our mind focuses on the largest number available, not the realistic one.

That’s not laziness. That’s human psychology.

Why yearly numbers fool our brain

Companies usually talk in yearly terms:

Big numbers feel powerful.

But your life runs monthly.

Our brain never naturally converts annual pay into real monthly cash unless we force it to.

This is where most people go wrong.

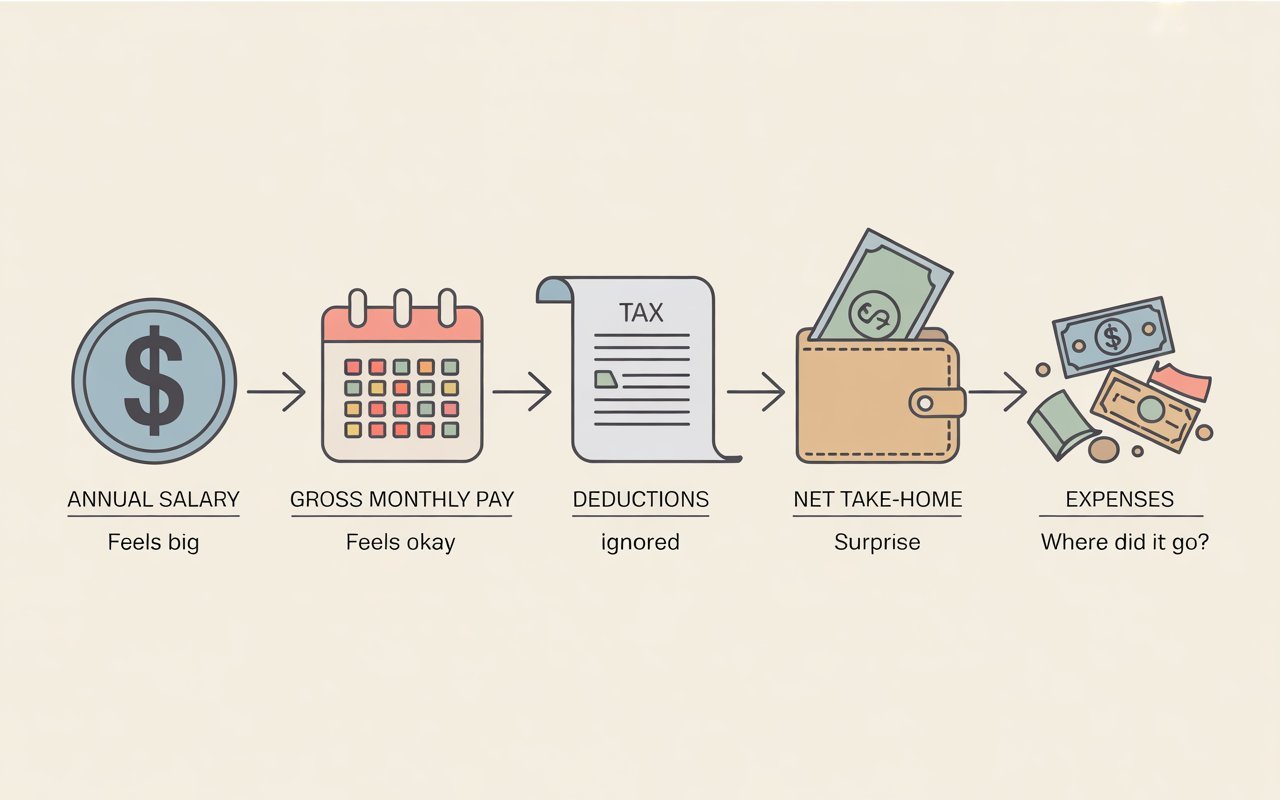

Gross salary is not your money. It’s a starting point.

Our real income is what’s left after:

Our brain still remembers the gross number.

Our bank account remembers the net number.

That mismatch creates stress.

Allowances sound like extra money.

But here’s the trick.

Some allowances:

Our brain adds them instantly.

Our wallet may not.

Bonuses are powerful mental traps.

Why?

Because our brain counts them before they arrive.

But bonuses are often:

Our mind feels richer.

Our monthly cash stays the same.

Complexity reduces questioning.

That’s a nromal human behavior.

When salary slips have many lines, people focus on just one thing:

“Amount credited: The final number that actually lands in your bank account each month.”

Everything else fades into the background.

This is why people who occasionally run their salary numbers through a simple salary-to-tax calculator suddenly feel more in control. The fog clears fast.

Most people budget like this:

“I earn X, so I can spend Y.”

But they calculate X incorrectly.

Our brain subtracts big expenses. It ignores small deductions.

Those small deductions add up silently.

That’s why money feels tight even when income rises.

Ever received a raise and still felt broke?

That’s because:

Our brain celebrates the raise.

Reality adjusts quietly.

Without recalculating take-home pay, the happiness fades quickly.

They do three things differently:

When negotiating or switching jobs, they quietly test different salary structures through a salary after tax calculator instead of trusting promises.

That’s where clarity comes from.

This isn’t deception. It’s marketing.

Companies frame salary the way brands frame prices.

Our responsibility isn’t to feel angry.

It’s to feel informed.

People who understand salary psychology:

Not because they earn more — but because they see clearly.

Because your brain remembers gross numbers while your life runs on net income.

Not necessarily. They present salaries in a way that sounds attractive. It’s your job to decode it.

Focus on take-home pay and compare salary structures instead of offers. Small changes matter more than you think.