Getting a job offer feels like winning. After interviews, waiting, and self-doubt, someone finally says “yes.”

But here’s the uncomfortable truth: some job offers are designed to look good at first glance and hurt later. The most dangerous red flags aren’t obvious. They’re quiet. Let’s talk about the seven job offer red flags nobody warns you about — but should.

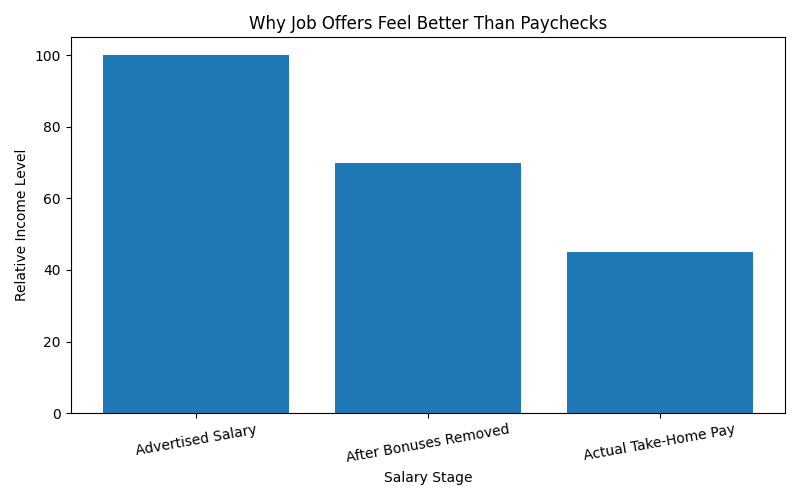

A common trick in job offers is leading with a large number.

Annual pay.

Total compensation.

Cost to company.

It sounds impressive.

But details are missing.

If the offer doesn’t clearly explain:

You don’t actually know what you’ll earn.

Many professionals only realize the gap once their first paycheck arrives. Running the numbers quietly through a salary-to-tax calculator often reveals a very different monthly reality than what the offer suggested.

Words matter.

“Up to”

“Performance-based”

“Target bonus”

These phrases sound optimistic but mean nothing guaranteed.

Here’s the trick

Our brain counts future money as present money.

But bonuses are often:

If a large portion of your income depends on bonuses, your financial stability depends on factors you don’t control.

When a job offer avoids specific working hours and instead talks about:

It usually means one thing.

Your time boundaries are about to disappear.

Long hours don’t always come with extra pay. Over time, this affects:

A higher salary means very little if you’re constantly exhausted.

“Fast growth.”

“Quick promotions.”

“You’ll move up soon.”

Sounds great.

But ask yourself:

Growth is mentioned verbally but never documented.

Years pass. Titles stay the same.

Smart professionals look for:

Without those, “growth” is just a motivational phrase.

This graph reinforces the salary illusion discussed earlier

Free snacks.

Team outings.

Wellness programs.

Nice to have but not life-changing.

When benefits are heavily emphasized, it sometimes distracts from:

Benefits don’t pay rent.

Cash flow does.

That’s why understanding monthly take-home pay matters more than flashy perks.

If a role description is broad but expectations are high, pause.

Phrases like:

Often mean:

You’ll do more than you’re paid for.

Unclear roles lead to:

A good offer clearly defines:

“This offer expires soon.”

“We need a quick decision.”

“Others are waiting.”

Pressure creates emotional decisions.

When rushed, your brain focuses on fear of loss, not long-term fit.

A healthy company allows:

If urgency feels manipulative, it usually is.

Because job offers come at emotional moments.

We Are relieved.

We want stability.

We want validation.

That’s when details get ignored.

Most people don’t analyze offers — they feel them.

Before saying yes, do this:

People who do this avoid regret.

Some professionals check different scenarios using salary calculators to understand how deductions and bonuses change real income. It’s not about mistrust — it’s about clarity.

Career experts often warn about unclear offers and rushed decisions. Resources like Harvard Business Review discuss why employees regret early career choices: (https://hbr.org/)

Similarly, job platforms like Indeed regularly highlight red flags candidates should watch for:[https://www.indeed.com/career-advice]

A good job offer:

If something feels off, it usually is.

Trust clarity over excitement.

Not always. But they should trigger questions, not silence.

Yes. Asking questions shows maturity, not arrogance.

Focus on monthly take-home pay, not titles or promises. Comparing structures makes hidden gaps obvious.