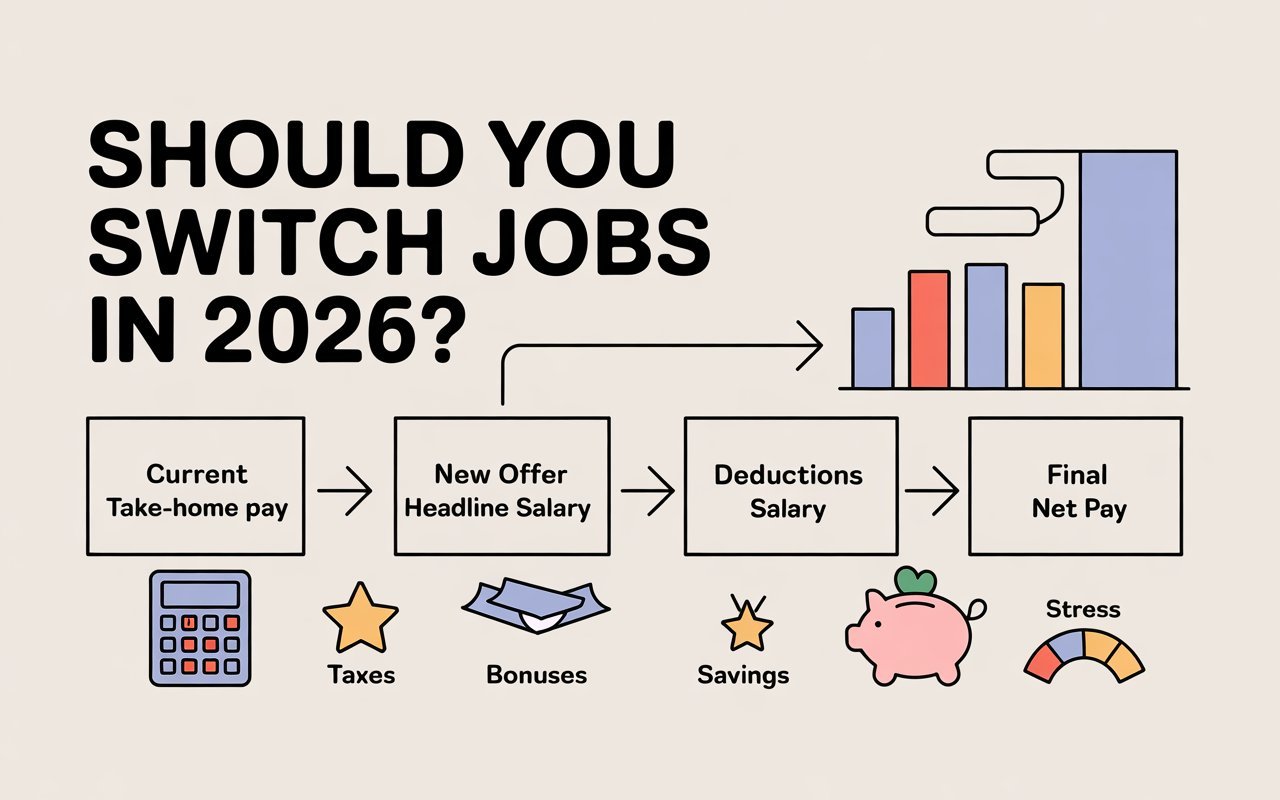

If you’ve been thinking about switching jobs in 2026, you’re not alone. Across the world, people are asking the same question: Is staying worth it anymore? Salaries are changing, costs are rising, and job offers look tempting. But before you make a move, it’s important to understand what actually improves your take-home pay, and what only looks good on paper.

The job market in 2026 doesn’t look like it did a few years ago.

Three big things have changed:

In simple terms, people are no longer chasing numbers. They are chasing clarity.

A higher offer is tempting. But a smarter offer is powerful.

Most people start here:

“How much hike will I get if I switch?”

That’s the wrong starting point.

The better question is:

“How much more will I actually receive every month?”

Because a 25% hike on paper can feel like 10% in reality.

And sometimes, a 10% hike can feel like freedom.

This is where most job switchers miscalculate.

Gross salary is the number you’re shown.

Real salary is the number you live with.

Your real salary is what’s left after:

Our brain remembers the gross number.

Our life runs on the net number.

That gap decides whether switching jobs feels worth it.

Many people say: “Switching jobs worked great for me initially.”

That “initially” matters.

Here’s why year one feels good:

But salary happiness fades fast if the structure isn’t solid.

By year two, what matters is:

That’s why looking only at the first-year number is risky.

Two people can earn the same total salary, and live very different lives.

Let’s take a simple example.

Example: Same Offer, Different Reality

| Component | Offer A | Offer B |

|---|---|---|

| Base Pay | High | Moderate |

| Allowances | Low | High |

| Bonuses | Large but annual | Smaller but monthly |

| Deductions | Higher | Lower |

| Take-Home Pay | Lower | Higher |

Why this happens:

This is why smart people test offers using a salary-to-tax calculator before deciding, not after joining.

Switching jobs isn’t free.

Even when the offer looks better, there are invisible costs.

Common hidden costs people ignore:

These don’t show up on offer letters.

But they show up in your mental health and savings.

Despite the risks, sometimes switching is the smartest move.

Switch if:

In simple terms, if effort has increased but money hasn’t, staying loyal stops making sense.

Switching isn’t always growth. Sometimes, staying gives you better long-term money.

Staying makes sense if:

A stable salary with steady growth often beats a flashy offer with uncertainty.

This is something many people forget.

Even if your salary increases, inflation may eat the difference.

What inflation does:

So the real question becomes:

“Is my new salary growing faster than my expenses?”

If the answer is no, switching jobs won’t feel rewarding for long.

Our brain loves change.

It assumes:

But psychology often exaggerates future benefits.

That’s why people feel disappointed after switching — not because the job is bad, but because expectations were unrealistic.

Testing salary scenarios calmly, instead of emotionally, removes this bias.

Here’s a simple method that works globally.

Annual figures hide reality.

Monthly numbers reveal it.

Ignore:

Focus only on fixed, recurring pay.

A higher title with lower take-home is not growth. It’s decoration.

Many people compare offers using an online salary-to-tax calculator to see what changes in structure actually mean for their bank account.

You can explore global hiring trends on platforms like

These trends explain why salary clarity matters more than job titles in 2026.

Here’s an uncomfortable truth.

Switching skills often pays more than switching companies.

Examples:

Sometimes, improving your value inside the same company increases income faster than job hopping.

Across countries, similar patterns are emerging:

What’s rising:

What’s declining:

This means salary growth is becoming more intentional, not automatic.

Here’s a rule many experienced professionals follow:

If a job switch doesn’t improve take-home pay by at least a meaningful margin, or clearly improve lifestyle, it’s probably not worth the risk.

Numbers should change your life, not just your LinkedIn profile.

Only if the switch improves your monthly take-home pay or long-term growth. A higher offer alone isn’t enough.

There’s no universal number. But small hikes often disappear after taxes, inflation, and new expenses.

Break everything down to monthly take-home pay. Testing different structures with a salary calculator removes guesswork and emotion.