Remote work changed how people earn money. It also changed how taxes work, even if many workers do not realize it yet. When you work from home, across borders, or for a company based elsewhere, tax rules quietly shift. Some shifts increase taxes. Others reduce them. This guide explains how remote workers can legally pay less tax by understanding structure, location, and planning choices before money leaves their paycheck.

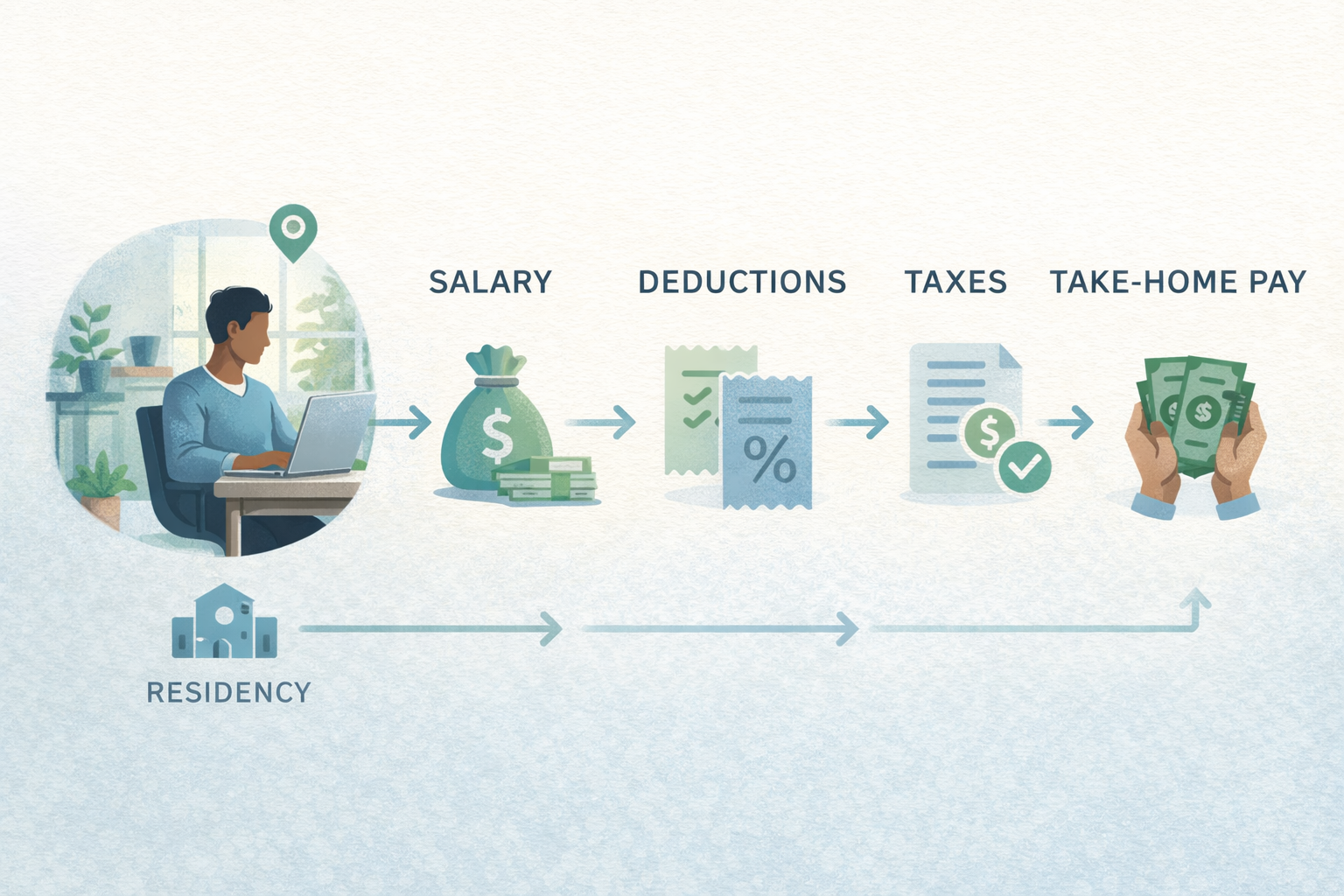

Remote work breaks traditional employment rules. Before, you lived where you worked. Now, income can cross cities, states, and countries while you stay in one place.

In simple terms, taxes depend on:

Remote workers often fall between systems. That confusion can cost money if ignored.

Many people assume taxes depend on the company’s location. That is rarely true.

In most countries, tax residency decides everything.

Tax residency is usually based on:

If you are a remote worker living abroad or moving frequently, your residency status can lower or raise taxes without changing your salary at all.

Location arbitrage means earning income from a high-pay region while living in a lower-tax or lower-cost place.

This works legally when:

Many remote workers accidentally overpay taxes because they never reassess their residency after moving.

Most people focus on salary size. That is the wrong starting point.

Taxes care more about:

Two remote workers earning the same amount can pay very different tax bills depending on structure alone.

This is why checking numbers with a salary-to-tax calculator before accepting remote offers often reveals savings people never expected.

Remote workers usually fall into two categories:

Employees often face:

Contractors often access:

Choosing the wrong classification can cost thousands yearly.

Remote work creates expenses traditional office jobs never allowed.

Common deductible categories include:

These deductions reduce taxable income, not take-home salary.

Many workers skip them simply because nobody explains them clearly.

Remote workers often receive:

Timing income affects taxes because:

Spacing income or planning payment dates can legally lower total tax exposure.

Remote workers earning across borders risk being taxed twice.

This happens when:

Most countries have agreements preventing double taxation, but they only work if you actively use them.

Ignoring this is one of the most expensive remote-work mistakes.

Some remote roles include allowances:

Allowances may be taxed differently than salary.

When structured properly, allowances reduce taxable income while keeping cash flow stable.

This is why comparing full compensation structures matters more than headline salary numbers.

Getting paid in a foreign currency feels harmless.

But taxes often calculate income using:

Currency swings can increase taxable income even if your real spending power stays the same.

Remote workers who track this carefully avoid surprises.

Remote work does not automatically remove social contributions.

Many systems still require:

Some countries allow exemptions for foreign income or self-employed workers.

Knowing this distinction alone can significantly lower deductions.

Some remote workers create:

This is legal when done correctly.

Structures allow:

But misuse creates penalties, so professional guidance matters here.

The biggest reason is simplicity.

Most people accept:

Remote income breaks defaults.

Without recalculating manually, you often pay more than required.

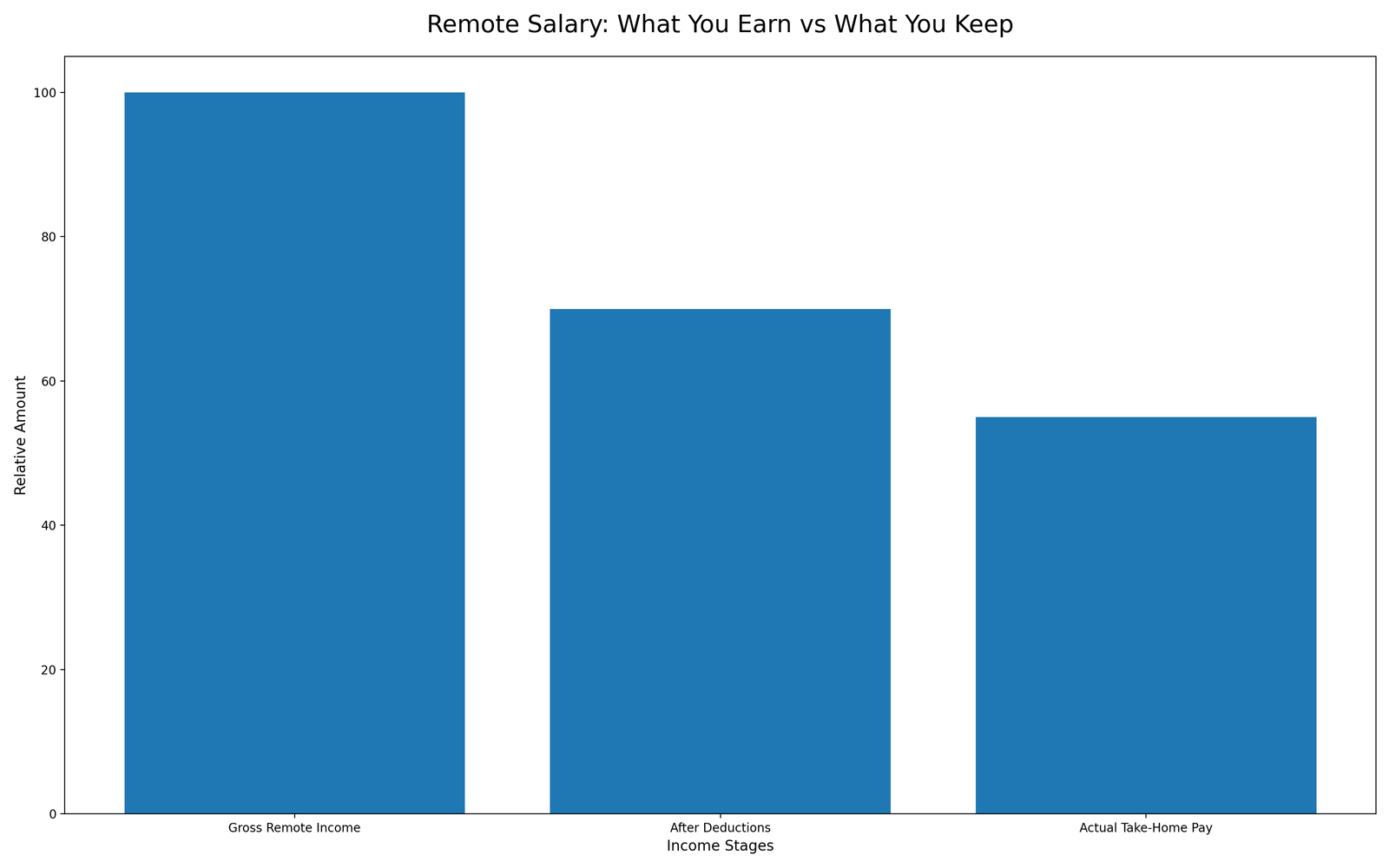

Two remote workers earn 70,000 units yearly.

Worker A:

Worker B:

Worker B legally pays less tax despite equal income.

The difference comes from structure, not loopholes.

Tax savings happen before filing, not during it.

Smart remote workers:

Tools that instantly show how deductions change take-home pay make planning far easier than guessing.

Tax systems encourage:

Legal optimization is expected.

Evasion is illegal.

Planning is not.

Knowing the difference protects you.

Always:

Most penalties come from carelessness, not strategy.

Many laws were written before remote work existed.

That creates gaps. It also creates opportunities.

Workers who stay informed benefit first.

When you understand how taxes really work:

You stop fearing payslips.

You start reading them.

Yes. Legal tax planning uses rules as written, not hidden tricks.

Not always. Structure and deductions alone can reduce taxes significantly.

Understand your net income. Compare scenarios calmly before making changes.